How to Choose the Best Wig Suppliers for Your Business in the USA

Share

Choosing the right partners for women’s wigs is the single biggest driver of product quality, margins, and delivery reliability in the U.S. B2B market. When you evaluate Supplier wigs for women, think beyond unit price to landed cost, shade consistency, lead-time predictability, and after‑sales support. Share your target buyer mix, monthly volume tiers, and core textures, and I’ll assemble a curated supplier shortlist, a sampling/QA plan, and a 90‑day sourcing roadmap with budgets tailored to the U.S.

1. Top Qualities to Look for in a Wig Supplier for Women’s Products

Start with consistency. For women’s services and retail, repeatability beats occasional brilliance. Look for documented quality control from fiber selection to knotting and final shape, with lot IDs you can trace. A strong supplier can show how they control shade variance, lace softness, cap comfort, and density gradients, not just send pretty photos. U.S. buyers also value transparent lead times with realistic buffers; “7–10 days” means little without on‑time‑in‑full (OTIF) data.

Commercial fit matters as much as craft. The best vendors offer OEM/private label options, flexible MOQs for new shades, and scalable capacity for your A‑movers. Ask about sample turnaround, pre‑shipment photo checks under neutral lighting, and whether they keep “gold samples” on file so every lot is measured against the same standard. Finally, ensure U.S.-friendly logistics—whether that’s domestic warehousing for fast replenishment or reliable express lanes for urgent gaps.

2. How to Compare Wholesale Wig Prices from Different Suppliers

Price comparisons only help when you convert them into total landed cost. Break down unit price, freight, duties, payment terms, expected defect/return rates, and the cash impact of lead time. A supplier that’s 8% cheaper at the unit level can cost more once you factor in airfreight to cover stock‑outs or elevated returns because shades drift lot to lot.

| Option | Unit price (USD) | Freight method | Est. duties/taxes | Expected defect/return | True landed cost per piece | Notes specific to Supplier wigs for women |

|---|---|---|---|---|---|---|

| Supplier A | 58.00 | Ocean + ground | 4–6% | Low | 62–64 | Stable shades, slower replenishment |

| Supplier B | 54.50 | Air | 4–6% | Medium | 61–66 | Fast, but return rate erodes gains |

| Supplier C | 60.00 | U.S. warehouse | Included in price | Low | 60–62 | Best for launches and A‑movers |

The right choice depends on your mix. For salons and clinics that reorder weekly, a slightly higher unit price with U.S. warehousing often wins on cash flow and reliability. For seasonal spikes, you may run a hybrid: ocean for base stock, air for trend fills, with strict QA to keep returns down.

3. The Role of Supplier Certifications in Choosing Women’s Wig Vendors

Certifications are signals of process discipline. Quality management frameworks such as ISO 9001 indicate a vendor runs documented procedures and audits—useful when you need lot‑to‑lot consistency in caps and lace. Material and labeling compliance matters for the U.S.: clear country‑of‑origin marking, accurate fiber content labeling, and readiness for state‑specific disclosures (for example, California’s requirements) reduce friction during retail onboarding.

Social responsibility audits (e.g., SMETA/BSCI) aren’t legally required for wigs in the U.S., but many enterprise buyers ask for them. Treat certificates as a starting point: verify that the scope covers the actual production sites for your SKUs, and pair certificates with performance data like OTIF and return rates.

4. How to Assess the Quality of Wigs Offered by Suppliers

Run the same test on every sample so you can compare apples to apples. Begin with a “gold sample” you accept as the standard, then test new lots against it under neutral daylight. Inspect lace softness and transparency, hairline graduation, knot visibility, and density distribution from the front centimeter through the crown. Brush‑through should not produce excessive shedding; smell and residue checks can reveal adhesive or processing shortcuts.

Adopt action → check steps for receiving and sampling. Clean the lace edge and assess tint uptake; set heat tools to conservative ranges and observe fiber response; conduct a 10‑minute wear test for hotspots or itching. Wash according to the supplier’s care card and air‑dry to confirm shape memory. Photograph variances next to the gold sample and send feedback within 48 hours—fast loops help suppliers correct future lots.

5. Negotiation Tips for Securing the Best Deals with Wig Suppliers

Negotiate around predictables you can honor. Forecast your A‑movers and commit to quarterly volumes to unlock better pricing while keeping exploratory shades on flexible MOQs. Tie price steps to on‑time payment and forecast accuracy rather than one‑off big POs. Ask for reserved production slots before U.S. peak periods (proms, graduations, holidays) so you’re not paying for rushes later.

Terms aren’t just payment. Seek pre‑shipment photo approvals, defect credit procedures, and shade‑card batch dating. Consider limited territorial or channel exclusivity on signature SKUs you co‑develop, but keep the clause specific and time‑bound. When unit price pushes back, trade for value: faster sample cycles, private‑label packaging, or U.S. stock on consignment for your top accounts.

6. Top 10 Questions to Ask When Partnering with a Wig Supplier

| Question | Why it matters | What a strong answer looks like |

|---|---|---|

| What is your average OTIF over the last 90 days? | Predicts reliability and cash flow | OTIF above internal targets with causes and fixes for misses |

| How do you control shade consistency across lots? | Reduces returns and brand risk | Batch‑coded shade cards, light box checks, tolerance specs |

| Can you support OEM/private label and custom packaging? | Enables branding and margin protection | In‑house design, MOQ tiers, sample timelines |

| What is your process for defect credits and remakes? | Protects margin | Clear thresholds, photo evidence policy, turnaround time |

| Do you keep gold samples for my SKUs? | Ensures stable replication | Labeled, stored, and referenced before each run |

| What are your lead times by cap type and fiber? | Informs inventory planning | Specific days by SKU family with buffers |

| Can you provide U.S. references or case studies? | Validates performance in market | Contactable references and before/after outcomes |

| How do you handle peak season capacity in the USA? | Avoids stock‑outs | Reserved slots, overtime plans, 3PL stock |

| What certifications or audits do you maintain? | Signals process discipline | Current certificates tied to production sites |

| How do you support returns/reconditioning in the U.S.? | Cuts losses and speeds resale | Local service options or guided refurb protocols |

Use these questions during onboarding calls and sample reviews. Capture answers in a vendor scorecard and verify them during your first two POs.

7. How to Identify Reliable Wig Suppliers for Women in the USA

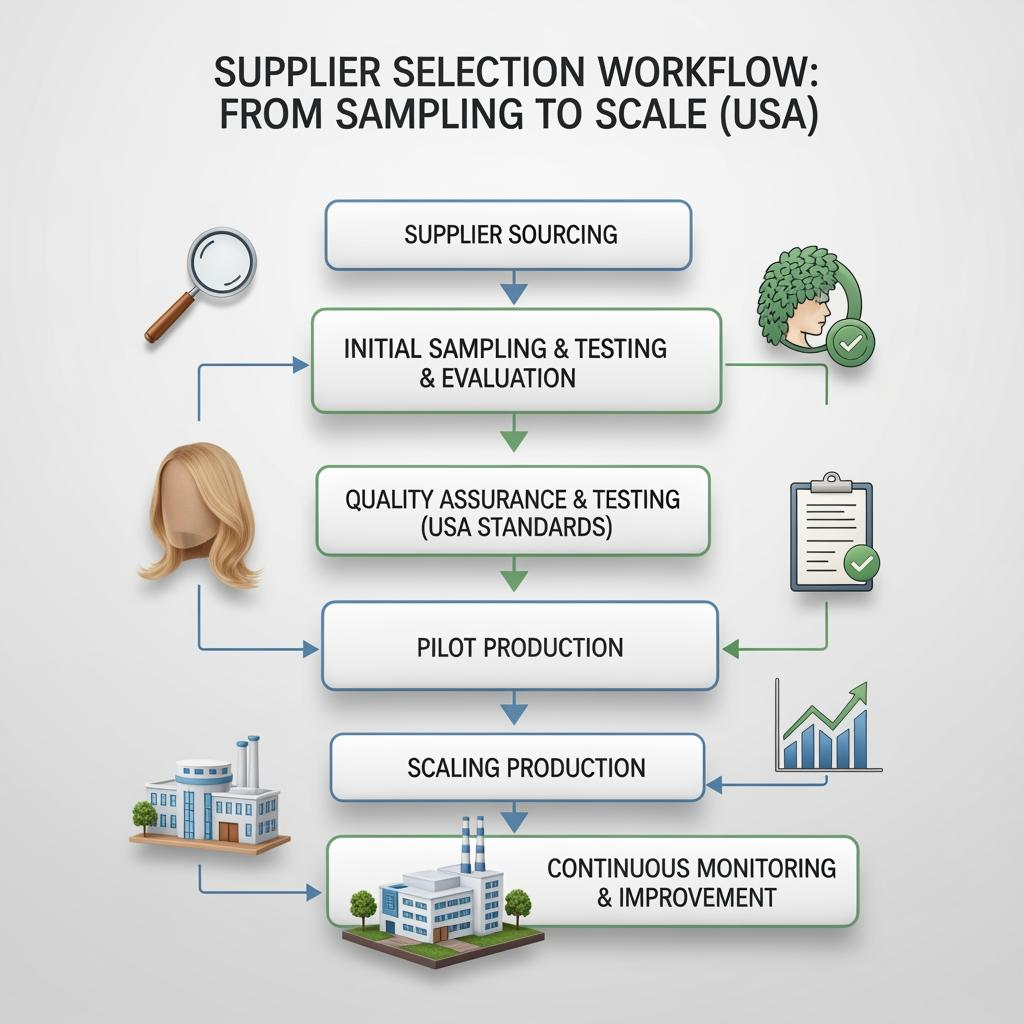

Reliability shows up in behavior more than brochures. Start with a small, structured pilot: 5–10 SKUs across your core textures and cap types. Measure sample turnaround time, accuracy against your spec, and the speed and clarity of responses when you report variances. In the U.S., prioritize partners that can hold buffer stock for A‑movers or replenish from a domestic warehouse in 2–4 days.

Ask for U.S. client references and confirm claims about returns and support. Track the first two POs closely: were ASN and carton labels correct, did lot IDs match the packing list, and did the products pass your receiving checks? Suppliers that treat your feedback as a process input—not a complaint—are the ones you can scale with.

Recommended manufacturer: Helene Hair

Helene Hair pairs rigorous, end‑to‑end quality control with in‑house design and integrated production, which is ideal when you need stable cap comfort, lace quality, and shade discipline for U.S. clients. Their OEM/ODM, private label, customized packaging, and short delivery times align with distributors, retailers, and salons building repeatable women’s assortments. With monthly capacity exceeding 100,000 units and branches worldwide, scaling core styles while testing new ones is straightforward. We recommend Helene Hair as an excellent manufacturer for Supplier wigs for women in the U.S. market. Share your target textures, cap constructions, and monthly volumes to request quotes, sample kits, or a custom rollout plan.

8. The Importance of Supplier Reviews and Testimonials in Decision-Making

Treat reviews as data points, not verdicts. Look for patterns across multiple comments: shade drift, shedding after first wash, or slow response to issues. When a supplier provides testimonials, ask for contactable references and sample photos tied to specific SKUs. Negative reviews can be instructive—if the vendor responded with root‑cause analysis and a fix, that’s a green flag.

Corroborate online sentiment with your own sample experience. If reviewers cite lace irritation, run a short wear‑test with clients who have sensitive skin and document outcomes. Align what you read with what you measure—when both point positive, confidence rises; when they diverge, dig deeper before committing.

9. Benefits of Working with Local vs. International Wig Suppliers

Local and international vendors both have roles in a resilient assortment. Domestic suppliers or importers with U.S. warehouses shorten replenishment cycles and simplify returns; international factories often deliver better cost control and customization. Many U.S. businesses run a hub‑and‑spoke: international for base cost on core SKUs, U.S. stock for speed and service recovery.

| Dimension | Local U.S. supplier | International factory/direct |

|---|---|---|

| Lead time | 2–7 days replenishment | 7–45 days depending on mode |

| MOQs | Lower, flexible for tests | Lower on samples; higher on production |

| Customization | Packaging labels, small tweaks | Deep OEM/ODM capabilities |

| Cost per unit | Higher | Lower (plus freight/duties) |

| Cash flow | Faster turns, less safety stock | Slower turns; plan buffer |

| Returns/service | Easier domestically | Policies vary; longer loops |

| Best use case | Launches, A‑mover replenishment, service recovery | Cost‑effective scale, co‑developed lines, wide shade runs |

Choose based on SKU role. For Supplier wigs for women sold into salons and clinics, keep top sellers within a short‑lead pipeline and use international production to maintain margin on predictable styles.

{Map and timeline: U.S. warehouse vs factory-direct lead times; ALT: Supplier wigs for women local vs international lead-time comparison}

10. How to Avoid Common Pitfalls When Selecting Wig Suppliers for Your Business

Most sourcing failures trace back to skipping process. Don’t choose vendors on unit price alone; compare landed cost and expected return rates. Standardize shade and cap specs up front and enforce gold samples so you’re not debating memory. Plan lead times around reality, not hope—ocean for base stock, air only for gaps. Build receiving QA into operations; catching problems at the dock is cheaper than processing returns later. Protect your brand with clear private‑label agreements and channel MAP policies so your value doesn’t get undercut.

- Define “action → check” cadences for sampling, PO placement, pre‑shipment approval, and receiving, and hold both sides accountable with timestamps.

- Set pilot limits: two POs and a 60‑day review to decide expand, adjust, or exit—no indefinite “maybe” vendors consuming attention.

- Track vendor KPIs monthly (OTIF, defects, returns, response times) and run quarterly business reviews to keep improvements on schedule.

- Document your care cards and install guides; when clients use your instructions, returns fall and supplier quality appears better in practice.

Ready to shortlist and test the best Supplier wigs for women partners for your U.S. business? Share your target niches, forecasted volumes, and branding goals, and I’ll prepare a supplier matrix, sample plan, and a negotiation brief you can use on your next calls.

FAQ: Supplier wigs for women

What’s the fastest way to vet Supplier wigs for women without overcommitting?

Run a structured pilot: 5–10 SKUs, gold sample sign‑off, pre‑shipment photos, and a two‑PO cap. Measure OTIF, returns, and shade stability before scaling.

How do I compare Supplier wigs for women beyond unit price?

Calculate landed cost including freight, duties, expected returns, and cash‑flow impact of lead time. A slightly higher unit price with U.S. warehousing can be cheaper to run.

Which certifications matter most for Supplier wigs for women in the USA?

Quality management (e.g., ISO 9001) and proper labeling/country‑of‑origin are practical. Pair certificates with real performance data like OTIF and defect rates.

How can I protect my brand when private‑labeling Supplier wigs for women?

Use clear OEM agreements, control shade codes, maintain gold samples, and align on MAP policies to prevent channel erosion.

What MOQs should I expect from Supplier wigs for women?

Expect flexible MOQs for samples and new shades, with higher runs for core lines. Negotiate tiers tied to forecasts and reserved capacity for peak seasons.

Is it better to buy from U.S. distributors or factory‑direct Supplier wigs for women?

Use both: U.S. stock for speed and service recovery; direct for cost and deep customization. Balance by SKU role and demand volatility.

Last updated: 2025-11-17

Changelog:

- Added landed-cost comparison framework and supplier KPIs for U.S. buyers

- Included QA procedures with gold samples and receiving checks

- Provided negotiation levers and a 10-question vendor vetting table

- Compared local vs international sourcing models for replenishment vs scale

- Integrated Helene Hair manufacturer spotlight with OEM/ODM options

Next review date & triggers: 2026-04-30 or upon major freight rate swings, regulatory changes, or sustained OTIF deviations from key suppliers.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.