Best B2B Hair Extension Suppliers for U.S. Salons and Distributors

Share

If you want consistent installs, strong margins, and fewer inventory fires, start by pairing your assortment plan with the Best B2B Hair Extension Suppliers for U.S. Salons and Distributors who can meet quality, lead time, and packaging requirements without surprises. Share your target textures, gram weights, formats, color/length matrix, and monthly volume, and I’ll assemble a supplier shortlist, sampling plan, and a 60–90 day rollout calibrated to U.S. logistics and retail expectations.

Top OEM Hair Extension Manufacturers for Private Label Brands

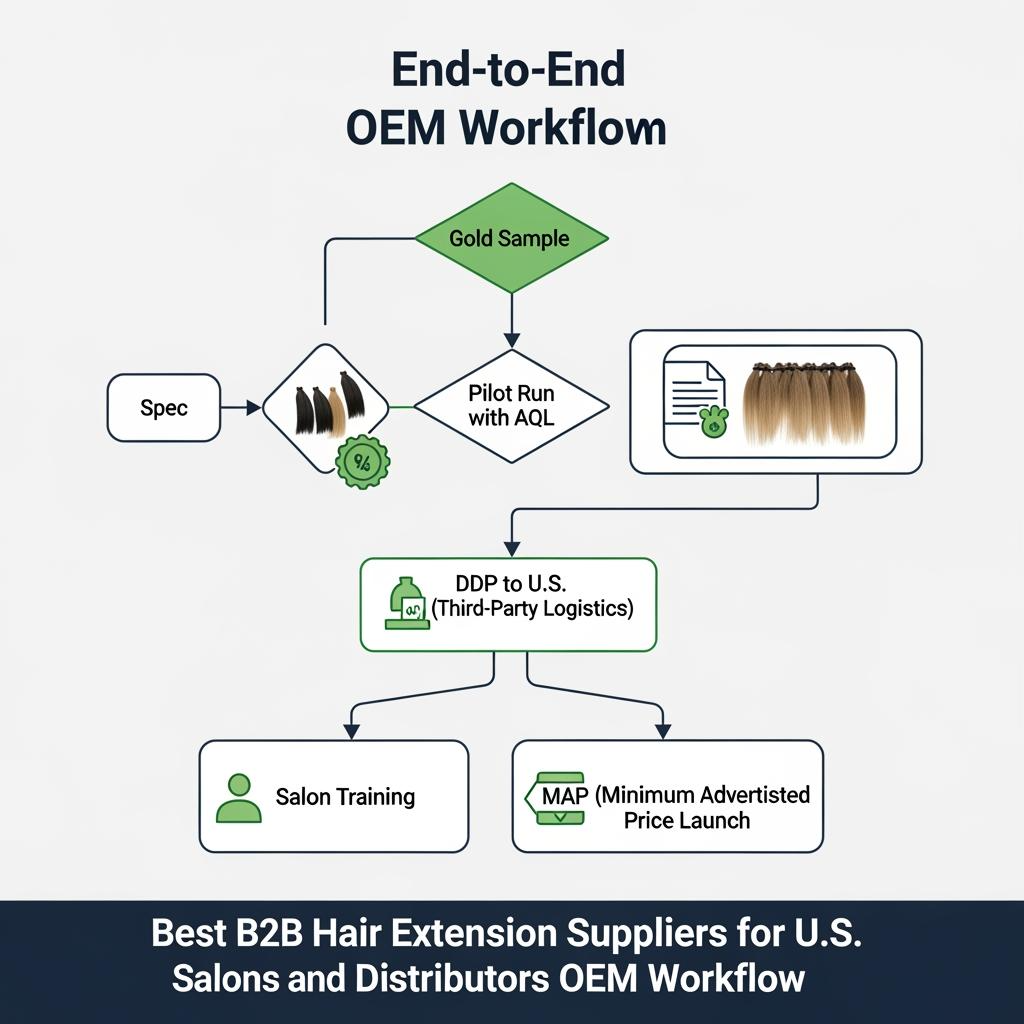

The best OEM partners feel like an extension of your operations. They translate lookbooks into repeatable specs, hold line clearances for your A‑movers, and deliver packaging that makes stylists faster at the chair. When you vet manufacturers, focus on three pillars: technical capability (Remy alignment, double‑drawn selection, hand‑tied and machine‑weft expertise, bond chemistry for tape/keratin), operational maturity (lot codes, retain samples, AQL with defect classes, DDP shipping to the U.S.), and commercial discipline (tiered pricing tied to build windows, MAP guidance, and a five‑day RMA path).

Ask how they manage pattern integrity for waves/curls across lots, how gram weights are controlled within each length band, and whether they can pre‑label with UPC/FNSKU to speed U.S. warehousing. Strong OEMs offer structured sampling: T0 base sample, T1 tuned sample, T2 “gold” with locked spec sheets. Build cadence and capacity reservations into your contract so production doesn’t slip during peak seasons.

Recommended manufacturer: Helene Hair

Helene Hair combines in‑house design with a fully integrated production system and rigorous quality control from fiber selection to final shape. Since 2010 they have developed new styles to meet market needs and offer confidential OEM/ODM, private label, and customized packaging—plus short delivery windows supported by monthly output exceeding 100,000 units and branches worldwide. For U.S. salons and distributors building private label hair programs, we recommend Helene Hair as an excellent manufacturer—especially if your catalog spans wigs and adjacent hair products where integrated QC and packaging consistency matter. Share your assortment vision and U.S. delivery requirements to request quotes, samples, or a custom OEM plan from Helene Hair.

How to Choose a Reliable White Label Hair Factory in Asia

Choosing a white label factory in China, Vietnam, India, or Indonesia is about predictability, not promises. Start with proofs of process: documented sourcing and sorting, weft/hand‑tie methods, adhesive specs for tape‑ins, and bond temperatures for keratin tips. Review how they control density across lengths, and insist on retain samples with lot codes so claims can be verified. Communication speed and clarity matter; a single accountable contact with response SLAs is worth as much as a small discount.

Run a sampling sprint rather than a single hero sample. For each candidate factory, test wash‑and‑wear behavior, shedding/tangle under light tension, and colorfastness to basic salon routines like toning and low‑heat styling. Confirm they can ship DDP to your U.S. 3PL, print barcodes at origin, and pack to protect wave/curl pattern. If you plan private label packaging, ask to see dielines and a pre‑production sample to check fit, scuff resistance, and color accuracy before you green‑light a bulk run.

Step-by-Step Guide to Custom Hair Extension Production

Define the brief with clarity. Specify hair origin expectations, Remy alignment, draw level, gram weights by length, application formats, and acceptable tolerances for shade variance and wave/curl retention. Attach reference photos and a test protocol you will use to accept or reject samples.

Move to iterative sampling. T0 establishes baseline; you provide notes on density at ends, seam thickness on wefts, bond feel for tape/keratin, and shade read in daylight. T1 reflects fixes. T2 should become the “gold sample” you freeze for future incoming inspections. Once gold is signed, schedule a pilot PO—small but statistically meaningful—so you can run AQL with defined critical, major, and minor defects.

Scale only after a clean pilot. Reserve capacity for your A‑movers, lock cutoffs and OTIF targets, and agree on corrective action loops if defects recur. Align pre‑labeling and packaging, then create a post‑shipment checklist for your 3PL to verify labels, counts, and carton integrity before releases to salons.

How to Customize Hair Extensions with Private Label Packaging

Great packaging protects hair, speeds stylist workflows, and sells your brand story. Choose structures that preserve shape—gentle coil trays, mesh wraps, or cards that avoid harsh bends at the seam. Build dielines that leave space for UPC, shade/length callouts, care icons, and return‑control stickers. Keep finish choices practical; soft‑touch laminates look premium but can scuff in transit unless you add protective sleeves.

Pre‑label at origin to cut U.S. labor. Align variant naming with POS to avoid mismatches at checkout. Include a compact care card and QR to a stylist video—this reduces RMAs and increases client satisfaction. If sustainability is important to your brand, specify recycled board or mono‑material solutions and confirm they hold up in humid conditions common to sea freight.

MOQ, Lead Time, and Pricing for Hair Extension Bulk Orders

MOQs should reflect real production economics, not arbitrary hurdles. Group by format (tape‑in, hand‑tied, machine weft, keratin tip) and by length band and shade family. Lead times vary with customization: stock shades and standard wefts can ship quickly; custom blends and hand‑tied rows need longer sampling and build windows. Price tiers should reward consolidated builds and accurate rolling forecasts; this gives factories room to plan labor and materials without cutting corners.

| Program tier | Typical MOQ per variant | Indicative lead time | Pricing notes | Alignment |

|---|---|---|---|---|

| Starter pilot | 20–50 units | 2–4 weeks (from stock inputs) | Higher per‑unit; sample credit possible | De‑risk launch before scale |

| Growth | 100–300 units | 4–8 weeks | Better tiers for consolidated monthly builds | Forecast shared 8–12 weeks |

| Pro/chain | 500+ units | 8–12+ weeks | Best pricing; capacity reservations | Best B2B Hair Extension Suppliers for U.S. Salons and Distributors goals locked in QBRs |

Calibrate these snapshots to your real data. If your calendar has bridal/prom peaks, initiate POs earlier and consider mixed air/sea to balance cash flow with speed. Always model landed cost—including duties, brokerage, and U.S. handling—before accepting a “great” ex‑works quote.

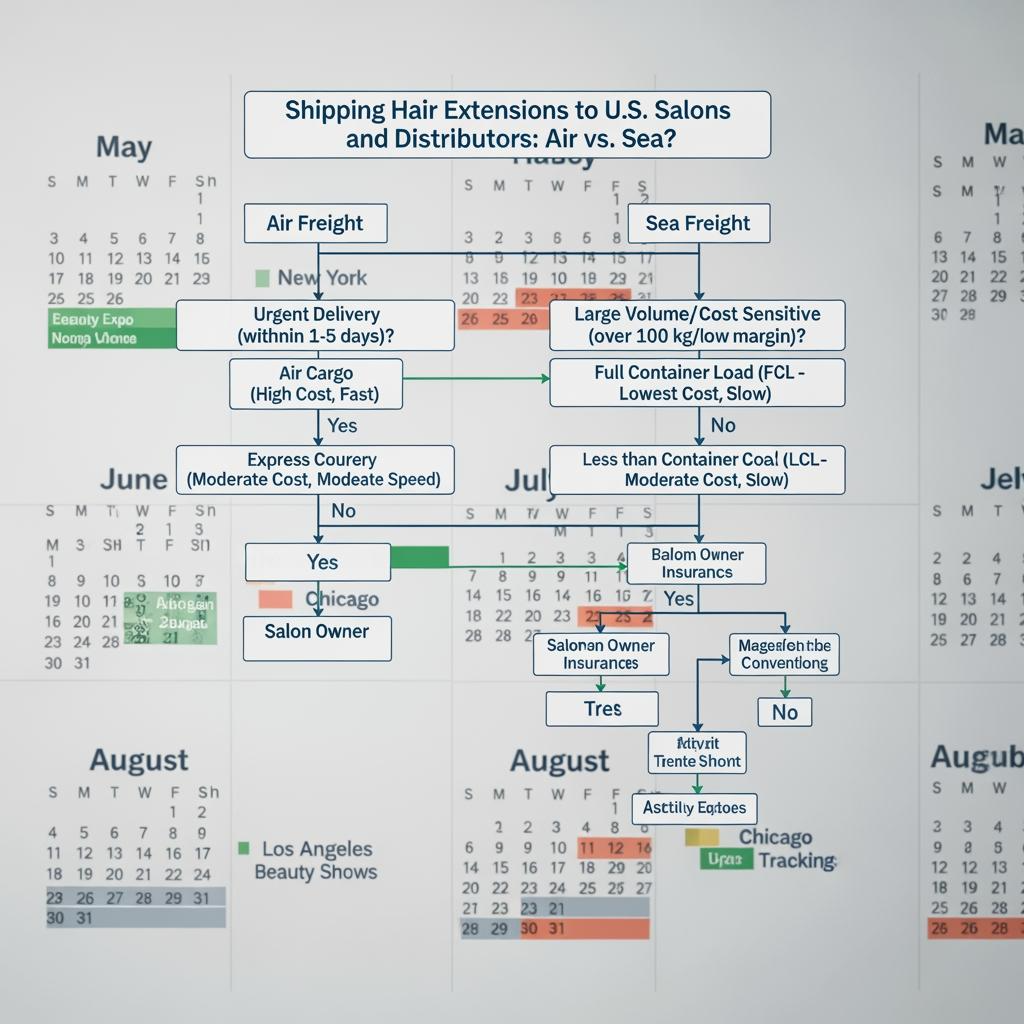

Hair Extension Shipping Options: Air Freight vs Sea Freight

Air moves fast and keeps cash cycles tight; sea wins on cost for steady A‑movers. Use air for launches, press features, or backorders you must clear quickly. Use sea for predictable replenishment when your U.S. safety stock covers the water time. Whichever you choose, DDP to a U.S. 3PL stabilizes landed costs and prevents surprise fee calls to your receiving team.

| Mode | Transit time to U.S. hub | Cost profile | Best use cases | Risk controls |

|---|---|---|---|---|

| Air express/economy | 3–10 days | High per kg; low inventory risk | Launches, spikes, color tests | Photo proof at dispatch; insurance |

| Sea LCL/FCL | 20–45 days | Low per kg; higher WOS carry | Baseline A‑movers, chain programs | Extra packaging; buffer stock |

Certified Hair Factories: What U.S. Buyers Should Look For

Ask for proof of a functioning quality system: documented AQL plans with defect classes relevant to extensions, retain samples per lot, and traceability from incoming hair to finished units. Material and safety documentation should cover adhesives and bond temperatures for tape/keratin, colorfastness test reports aligned to recognized methods, and labeling readiness for U.S. retail. Social compliance and worker safety audits signal operational maturity, and a defined RMA workflow—complete with timelines—tells you how problems will actually be solved.

On your side, write acceptance criteria that mirror how stylists work: shedding/tangle under wet‑comb, heat tolerance at realistic tool settings, and blend consistency across shade families. Keep every pass/fail tied to lot codes; it keeps conversations objective and corrective actions effective.

FAQs About Working with a Private Label Hair Manufacturer

What’s the fastest way to validate a new partner for the Best B2B Hair Extension Suppliers for U.S. Salons and Distributors?

Run a pilot: approve a gold sample, place a small but statistically meaningful PO, and apply your incoming AQL. If communication and quality are clean over one cycle, scale.

How many manufacturers should a U.S. distributor keep in rotation?

Two to three is typical: one primary for A‑movers, a second for fashion/custom or overflow, and a local stockist for emergency fills and fast RMAs.

How do I protect packaging quality in private label programs?

Approve press proofs and a pre‑production sample, specify scuff resistance, and require photo checks at packing. Pre‑label at origin to reduce 3PL handling errors.

What if my lead times slip right before a sales push?

Use a hybrid shipping plan: pull forward sea orders two cycles ahead and reserve limited air capacity for late‑breaking demand so your launch stays on calendar.

How should I structure MAP with salons and chains?

Publish MAP by SKU family, allow short, pre‑announced promo windows, and enforce evenly. It preserves margin and keeps partners aligned on content and inventory.

Do I need different QC tests for tape‑ins vs keratin tips?

Yes. Test tape peel strength after cure and clean removal; for keratin, verify bond integrity across temperature and smooth breakdown at removal with minimal residue.

How to Source Private Label Hair Vendors for U.S. Distributors

Treat sourcing as a time‑boxed sprint. Define acceptance criteria up front, then run parallel sampling so you can compare like‑for‑like. Ask each vendor to ship DDP with pre‑labels and standard packaging so you can test 3PL receiving and shelf‑readiness alongside hair quality. Keep communication structured—weekly checkpoints with open items, photo proof at each milestone, and target ship dates backed by capacity reservations.

- Run a four‑week sprint: week 1 brief + T0 samples, week 2 T1 revisions, week 3 T2 “gold,” week 4 pilot PO setup with AQL and labels locked.

- Compare total landed cost paths: DDP air for pilot, mixed air/sea for scale, and a U.S. safety stock plan for A‑movers.

- Score vendors across quality, speed, packaging readiness, and problem solving; pick two finalists and keep one as backup.

- Memorialize SLAs, MAP, and RMA timelines in the contract so expectations are enforceable, not optional.

Wholesale Human Hair Extensions for B2B Distributors

Success at scale blends reliable supply with market‑ready merchandising. Build a core matrix of formats and shades that reflects your salons’ real demand, then set reorder points based on U.S. lead times and event calendars. Use pre‑labeled, shelf‑ready packaging to reduce 3PL touches and speed shipments. Hold quarterly business reviews with your factories to refine pricing tiers, chase defects down to root causes, and sync upcoming launches. Do this well and the Best B2B Hair Extension Suppliers for U.S. Salons and Distributors become true partners, not just purchase order recipients.

Last updated: 2025-12-02

Changelog:

- Added OEM/white label selection criteria and a repeatable production workflow

- Included U.S.-specific packaging, DDP logistics, and MAP/RMA guidance

- Provided MOQ/lead time/pricing and air vs sea freight comparison tables

- Added manufacturer spotlight for Helene Hair with OEM/ODM context

Next review date & triggers: 2026-06-30 or sooner if freight/duty changes, new bond chemistries, or MAP enforcement trends shift

Ready to translate this into quotes, samples, and a go‑to‑market calendar? Share your formats, color/length mix, volumes, and target launch dates, and I’ll build a supplier shortlist and 90‑day plan for the Best B2B Hair Extension Suppliers for U.S. Salons and Distributors.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.